Happy first DRR of 2017! I was kinda sad about this month, because I’d been all fired up about paying off everything in the world, but then life happened. Life I probably should have prepared for last month instead of throwing my entire accident settlement at my debt, but whatever. Here’s something interesting. I compared these numbers to my January 2016 debt repayment recap, and I’ve dropped my car loan by 4.21%, my credit card by 60.67% and my overall debt by 9.38%. The general trend is down.

December 30, 2016

Car Loan: $17,205.22

Credit Card Debt: $320.64

Total: $17,525.86

January 30, 2017

Car Loan: $16,894.50 (-1.8%)

Credit Card Debt: $699.16(+118.05%)

Total: 17,593.66 (+.38%)

My credit card debt went up, and here’s why. Just like last year, when my credit card debt mysteriously shot up in the month of January, I made an impulsive decision to visit Nashville. I’d assumed I’d be able to pay it off quickly, but then we had an unexpected winter storm and I was snowed in, unable to work, for a week. It hurt me, bad.

Unlike last year, though, I’m not going to let this deter me in the long run. Last year I got discouraged by the detour and kind of threw in the towel on the whole thing. Not this year.

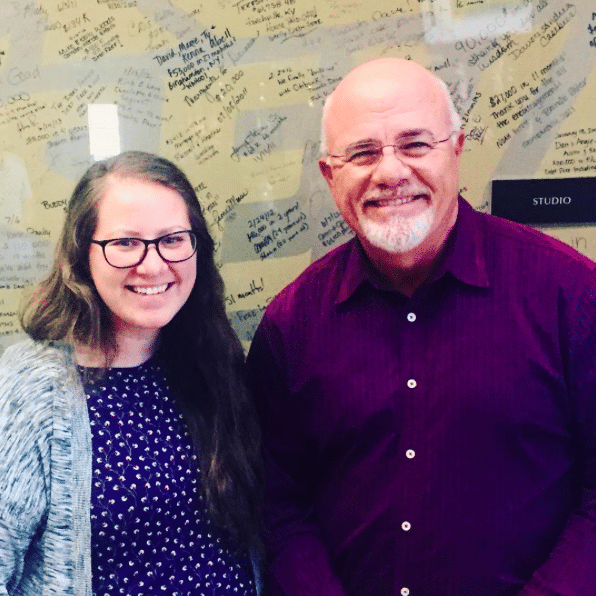

You know what was cool, while I was in Nashville, Ernie took me to THE DAVE RAMSEY SHOW. and GUESS WHO I MET!!!!

Y’all, it was SO COOL. They have a cafe where they GIVE AWAY FREE MOCHAS. and COOKIES! It was awesome. This is the show we were there for:

https://www.youtube.com/watch?v=WHDc31le9rU

I did feel ULTRA guilty that I was there because of a credit card, though. Next time that won’t be the case… and maybe the time after that, I can do a debt free scream 😀

For February I’m doing the cash-only system, so I’m hoping that’s going to help free up a bunch of money to get that credit card problem taken care of!

How did y’all do with your financial goals during January?